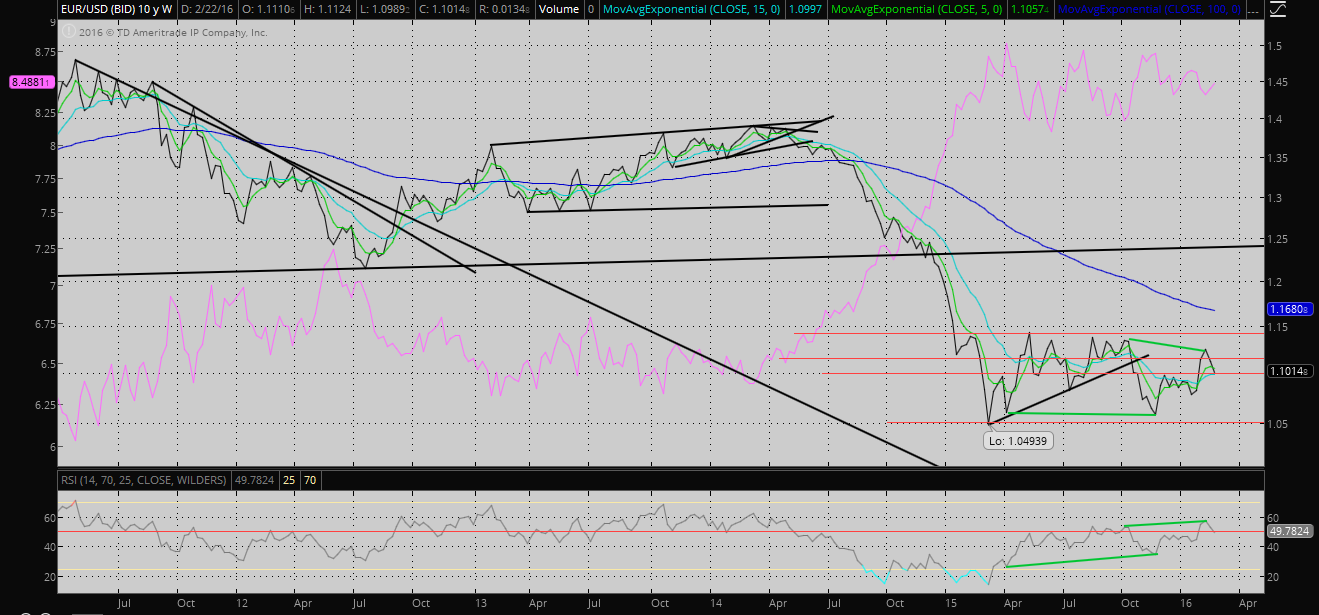

So, the Euro lost its support during trading a couple days ago as it penetrated 1.10 to the downside. It since regained this support level, but not strongly and as such I believe it’s due to continue downwards towards 1.09.

EUR Short-Term

The top appears to have been resistance at 1.132 which I did not note as a resistance line (since I failed to notice it). As such my calling for potentially 1.14 was wrong.

The top appears to have been resistance at 1.132 which I did not note as a resistance line (since I failed to notice it). As such my calling for potentially 1.14 was wrong.

I believe the EUR/USD has completed a small H&S pattern with the neckline already broken. The current target is a 100% (equal decline) of what the distance is from the top of the pattern (head) to its neckline. Better visualized by looking at the chart. This leaves us with a target around 1.087ish, but because of the sideways nature of the pattern this target is a little rough. As such we may find (some) support then at 1.09 due to price action consistently playing in that area.

The RSI very clearly topped and can still drop at this point.

EUR Mid-Term

EUR/USD toys with (psychological) support at 1.10. RSI action will be important to watch on this chart for the rest of the week. 50 has acted as a rough bear/bull market indicator for the past couple years and its currently toying with penetrating that level to the downside. Given the target of 1.09 in the ST chart I am inclined to believe we will go below 50 significantly enough. Opening up the possibility for a retest of 52 wk lows. But it’s still too early to call that.

EUR/USD toys with (psychological) support at 1.10. RSI action will be important to watch on this chart for the rest of the week. 50 has acted as a rough bear/bull market indicator for the past couple years and its currently toying with penetrating that level to the downside. Given the target of 1.09 in the ST chart I am inclined to believe we will go below 50 significantly enough. Opening up the possibility for a retest of 52 wk lows. But it’s still too early to call that.

EUR Long-Term

And we went back below that longer-term uptrend, although this week isn’t closed yet so cannot say that with complete certainty. RSI isn’t worth commenting on.

And we went back below that longer-term uptrend, although this week isn’t closed yet so cannot say that with complete certainty. RSI isn’t worth commenting on.

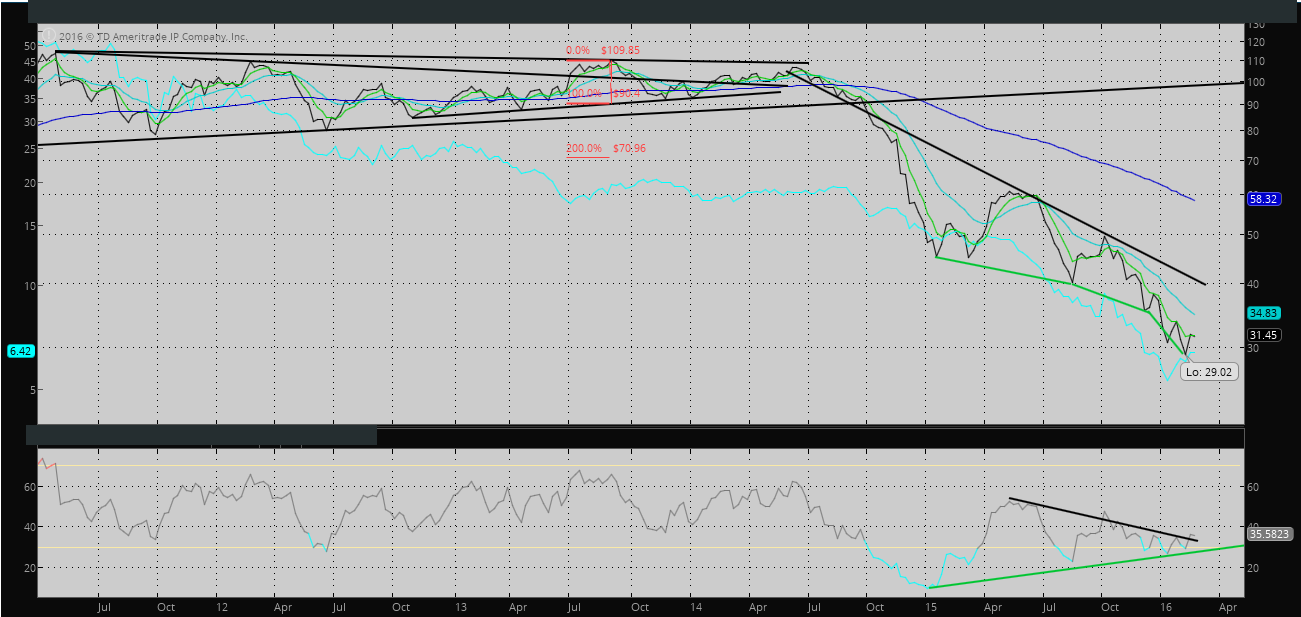

I would bet that day-traders of Oil are having the time of their lives on this rollercoaster. Oil bounced at $27 support level and the following price action has been a bit interesting (also defying ‘fundamentals’ for the most part as production increases worldwide all while it is becoming very difficult finding places to just store oil).

Oil Mid-Term The RSI wedge I noted last time may be breaking to the upside. Which opens the possibility for a much stronger rally in oil (don’t get too excited; stronger as in maybe touching $40 at the down trend-line) when considering the built-up divergence as well. What is also interesting here is that coal has started trending upwards for now…

The RSI wedge I noted last time may be breaking to the upside. Which opens the possibility for a much stronger rally in oil (don’t get too excited; stronger as in maybe touching $40 at the down trend-line) when considering the built-up divergence as well. What is also interesting here is that coal has started trending upwards for now…

Oil Long-Term

Right now Oil is playing with the resistance line at $32. In the daily sessions it has touched/exceeded that level a couple times but clearly still is struggling to regain it. That RSI divergence in the LT kinda came back. Wouldn’t pay it that much attention at the moment though.

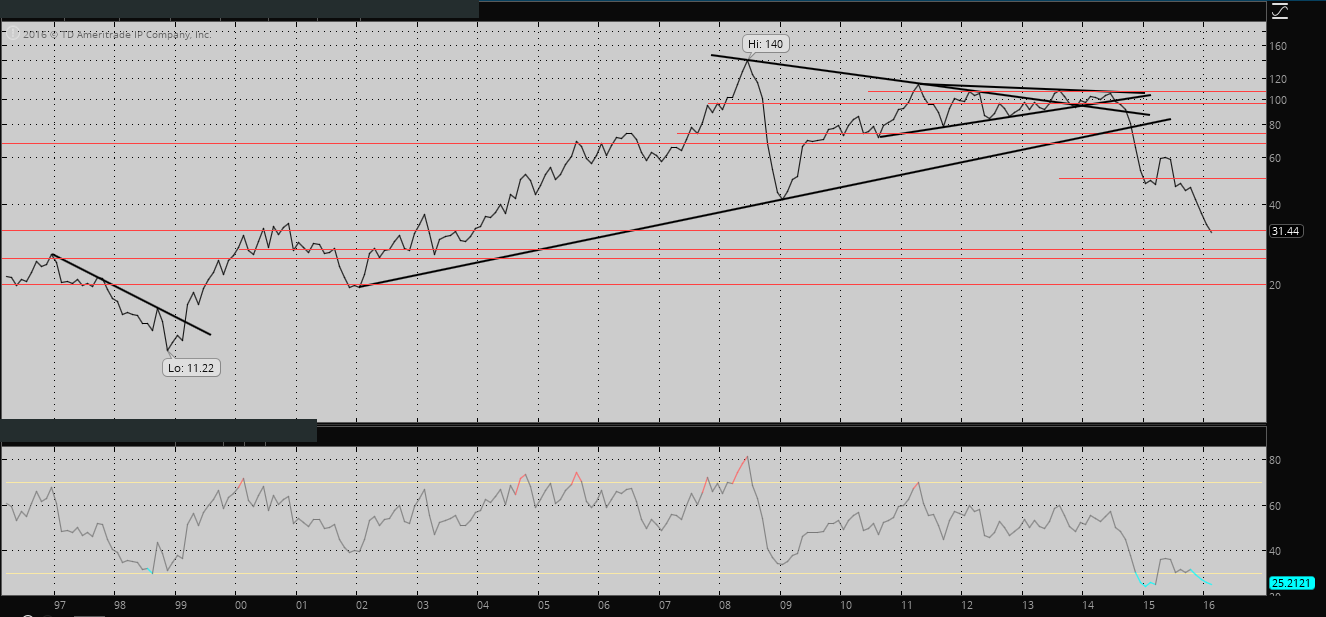

And now for TF.

TF Short-Term 1000 has clearly been regained. Whether or not this is only due to shorts covering though…I don’t know. However, RSI has a favorable trend and has room to move higher as well. If resistance at 1015 is broken we likely see 1050, perhaps stopping short at 1040.

1000 has clearly been regained. Whether or not this is only due to shorts covering though…I don’t know. However, RSI has a favorable trend and has room to move higher as well. If resistance at 1015 is broken we likely see 1050, perhaps stopping short at 1040.

TF Mid-Term There is one thing in this chart of particular significance. The RSI level based on historic comparison is extremely low. I am inclined to say that if resistance levels such as 1015 and 1050 are regained we could definitely see 1100 regained, easily. The blue moving average may act as a resistance target.

There is one thing in this chart of particular significance. The RSI level based on historic comparison is extremely low. I am inclined to say that if resistance levels such as 1015 and 1050 are regained we could definitely see 1100 regained, easily. The blue moving average may act as a resistance target.

LT chart (monthly) doesn’t show anything particularly interesting so that’s left out.

Free Bonus! (OH YEAH) I sound like one of those ‘binary options’ sites

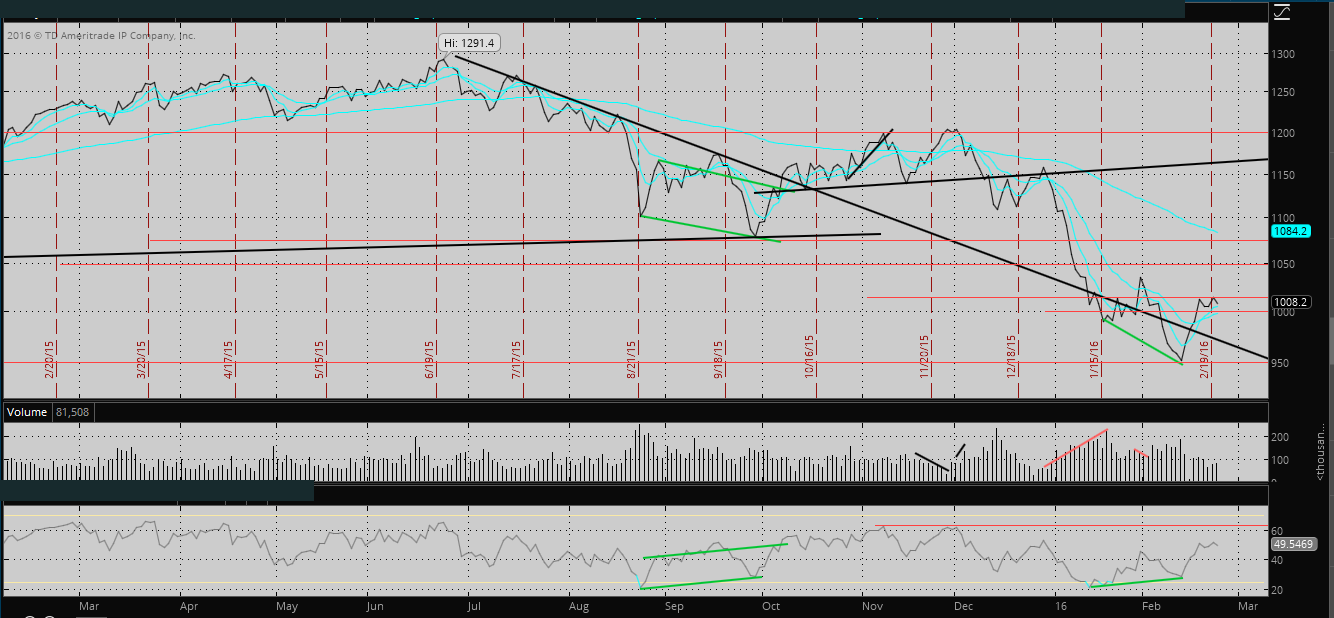

Decided to analyze SPX ( despite its constant manipulation by algos and their associated ilk ) as it has more historical data by which the RSI can be judged (TF’s only goes back 10 years).

SPX Remember that the following analysis is worth less due to the high volume of algorithmic trading which goes on in the S&P 500. Such algorithms are aware of s/r levels, RSI trends, etc and know that enough humans trade off these levels so such algorithms will purposefully manipulate price (through quote-stuffing etc.) to run stops and make shorter-term moves generally erratic. Anyways.

Remember that the following analysis is worth less due to the high volume of algorithmic trading which goes on in the S&P 500. Such algorithms are aware of s/r levels, RSI trends, etc and know that enough humans trade off these levels so such algorithms will purposefully manipulate price (through quote-stuffing etc.) to run stops and make shorter-term moves generally erratic. Anyways.

The SPX is playing with a current resistance level. RSI was at a 5 yr low(!!) and may be recovering right now. However, please look at 2008 and notice that the RSI has played this game before (including slight bullish divergence). With everyone screaming that this isn’t 2008 all over again I’m starting to wonder if it is 2008 all over again. There is a small bullish divergence between the RSI and current price action. What is key right now, is for the S&P first to regain that resistance level and thereafter to regain its 80 wk (400 day) EMA. With a significant regain of that MA we could see a large rally akin to 2011/12.

Other worthless thoughts:

Armstrong mentioned something about the EUR collapsing by March 14th. I don’t know if I can agree with that, but if it does, then this would definitely give equities a reason to violently collapse…although devil’s advocate in me says except for the fact that maybe everyone from Europe then invests in US equities in order to prevent total wealth loss from #currencyprobs, leading to a final rally in US stocks…and then the final top and violent down move which wipes out the previously invested capital.

I do believe that this market has a maximum life-time of 2 years left and probably more like one year left. Perfect timing for my graduation. Another awful job market coming right up. Yey.

But worrying about the future does not really end up producing something. So I’ll just sit back and listen to some Arms and Sleepers. Also producing mostly nothing. But then again it’s 4AM and probably a good time for producing some Z’s.

Comments

Pingback: TEST Russell Rally; Target Acquired Juliet, over – Oil’s great inflection – Boring Euro | Eric's TA Alcove