Let’s just get to it shall we.

EUR

Short-Term So a while ago I had said the target was reached and while that was correct, this was just the resistance target. A short while later we did actually move even higher to basically match 1.1445. Thereafter we teased the resistance level a couple more times and then kind of ‘crashed’ spectacularly. As you can see now we

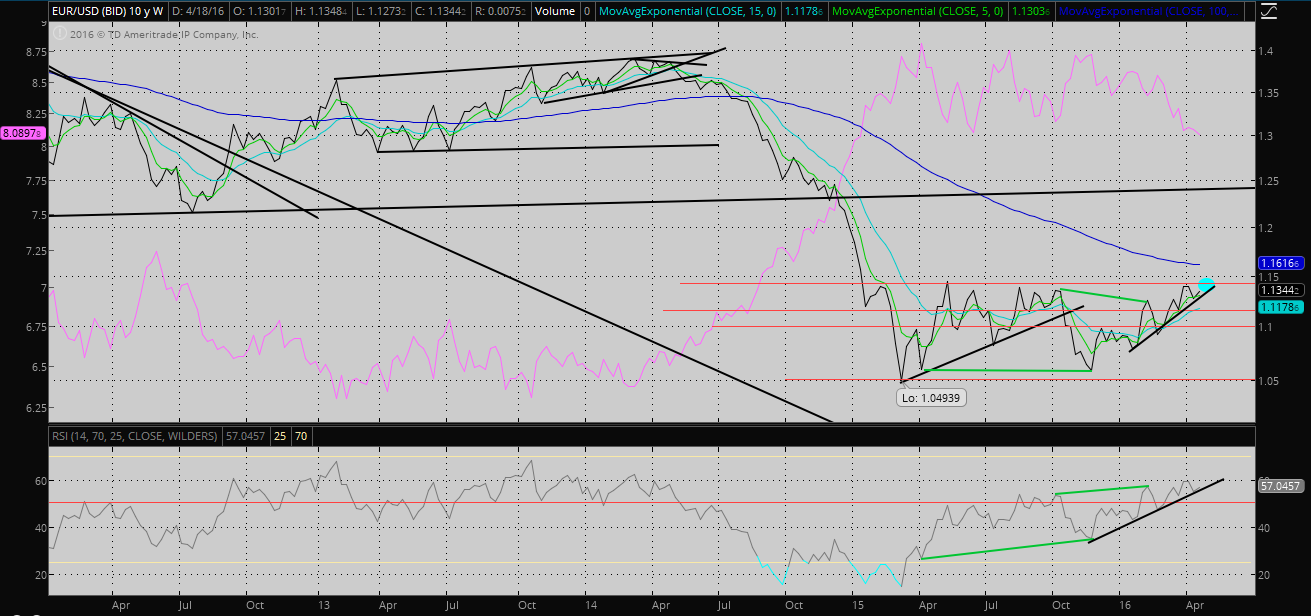

So a while ago I had said the target was reached and while that was correct, this was just the resistance target. A short while later we did actually move even higher to basically match 1.1445. Thereafter we teased the resistance level a couple more times and then kind of ‘crashed’ spectacularly. As you can see now we are were right between a support and resistance line. However as of this moment we are currently above the line at 1.13425. I believe that if there is a close above 1.13425 we may retest major resistance at 1.1425 or higher. On the other hand if we break 1.132 with a close, then it’s probably back to 1.12.

While momentum is a bit downwards from the recent down move, this also allowed RSI to really get to a nice neutral level with the potential to move higher. Therefore with the RSI at a somewhat desirable level, the move underway at this moment which is taking us above 1.135, and the medium-term chart below I am beginning to think the EUR may see a major breakout above the 1.1425 resistance.

Mid-Term Price has been in an uptrend for a while now. RSI still has room to move higher. If the daily close is above 1.135 there is a very good chance of a breakout above the resistance line occurring IMO.

Price has been in an uptrend for a while now. RSI still has room to move higher. If the daily close is above 1.135 there is a very good chance of a breakout above the resistance line occurring IMO.

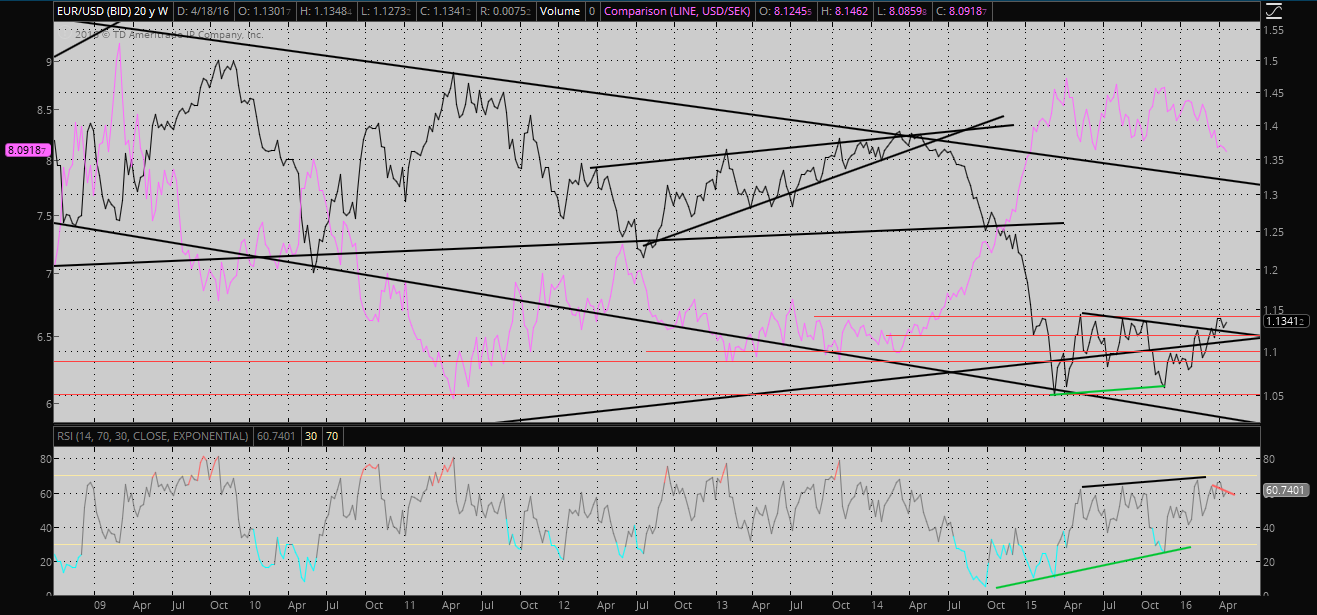

Long-Term With the long-term chart there isn’t much to see except for the RSI not confirming price at this point in the week. Since the week has a ways to go though this doesn’t really mean much. There is heavy trend-line support below the current price.

With the long-term chart there isn’t much to see except for the RSI not confirming price at this point in the week. Since the week has a ways to go though this doesn’t really mean much. There is heavy trend-line support below the current price.

OIL

Mid-Term I said:

I said:

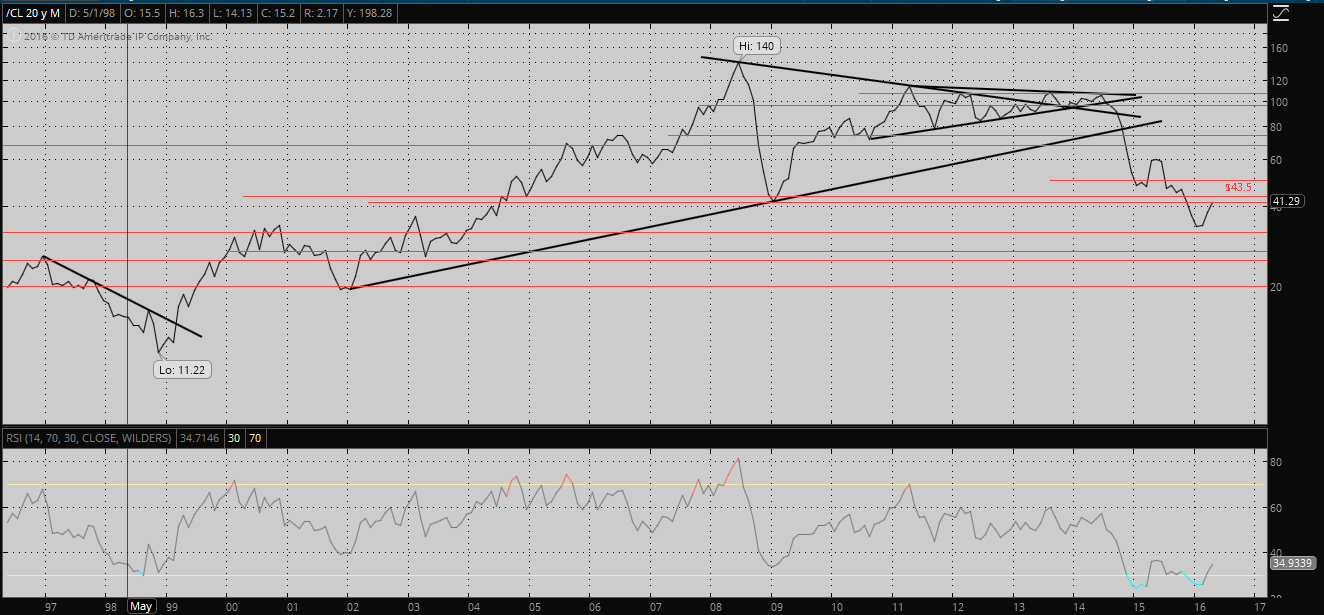

if we go back to say $36, we will probably be meeting up with $32 again real soon.

We did actually go back to 36 and slightly below but as you can see we did not close below this. Close was at 36.7 and for whatever reason (insert Doha here if you want) oil decided to reverse there. Since then it Coal has been tracking with Oil rather well so there’s nothing to talk about there. Oil is currently toying with 41.5 which IMO is the key level it needs to close above for a more sustained rally. If it does close above this level, then Gartman will probably be within $0.50 of pushing daisies. See LT chart for resistance @ 43.5.

Long-Term So this chart is already kind of outdated as oil is closed around 42.5 now ($42.42, dat symmetry tho illoominati confirmed). As such I do think we will touch 43.5 at least if not higher. All thanks to fundamentals, right?

So this chart is already kind of outdated as oil is closed around 42.5 now ($42.42, dat symmetry tho illoominati confirmed). As such I do think we will touch 43.5 at least if not higher. All thanks to fundamentals, right?

Pretty sure fundamentals will eventually make a screaming comeback, but at this moment it looks like they’re fairly dead.

Speaking with a more balanced view though…while Iran wants to sell oil it doesn’t have the boats to do so.

Those kind of quality articles are what first brought me to reading zerohedge. Unfortunately it seems there are less of them as time goes by and more and more political silliness.

Anyways…

TF

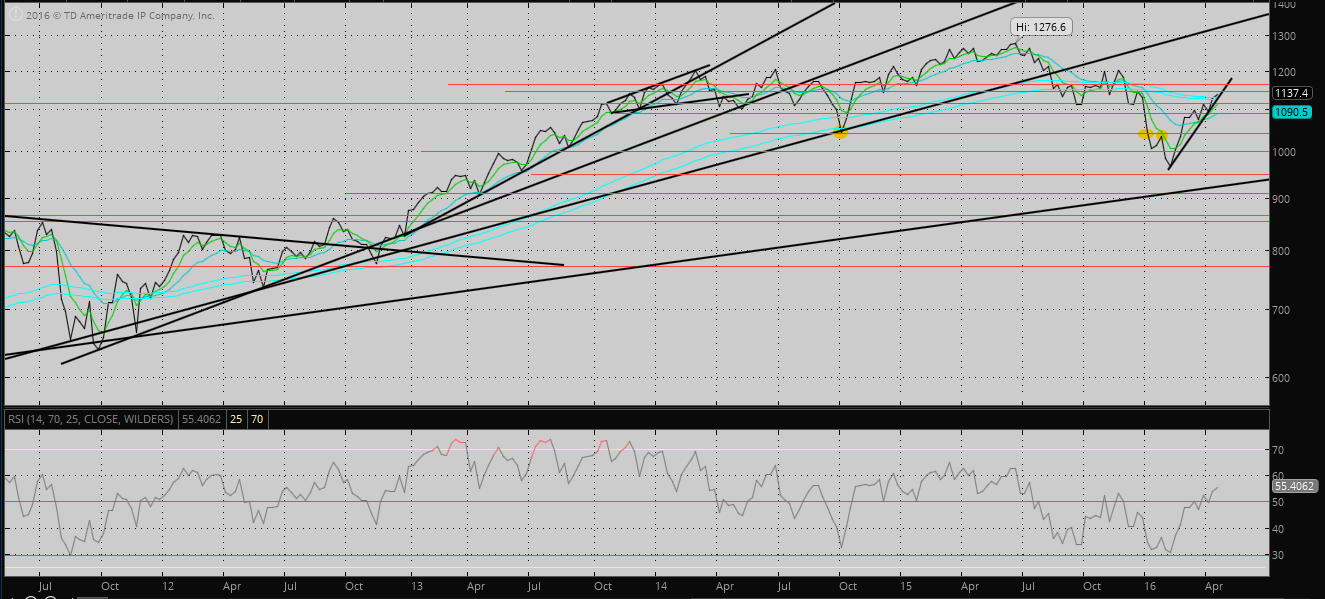

Short-Term As can be seen price is currently in a bit of a channel and at the very top of this right now. An obvious target at this point would be 1145 but how long it takes to get there may be limited by the channel. However the channel is not extraordinarily significant so it might just be broken…but with the declining volume coupled with RSI starting to get close to overbought, maybe we do test some supports first and then slowly work back towards passing 1145.

As can be seen price is currently in a bit of a channel and at the very top of this right now. An obvious target at this point would be 1145 but how long it takes to get there may be limited by the channel. However the channel is not extraordinarily significant so it might just be broken…but with the declining volume coupled with RSI starting to get close to overbought, maybe we do test some supports first and then slowly work back towards passing 1145.

I think I might have also just noticed a giant inverse h&s pattern…which if completed would likely wipe out every last bear as we near the ATH. And then we’d get the final top. Which by the time this all happens would start to tie in nicely with a new US president as the markets really begin to panic. But let’s see how price plays out towards 1145 first.

Mid-Term Nothing real exciting here. On a steep trend-line at the moment, possibly regaining an important moving average but it’s not strongly taken back enough to confirm yet. RSI is rather constructive and has plenty of room to move higher.

Nothing real exciting here. On a steep trend-line at the moment, possibly regaining an important moving average but it’s not strongly taken back enough to confirm yet. RSI is rather constructive and has plenty of room to move higher.

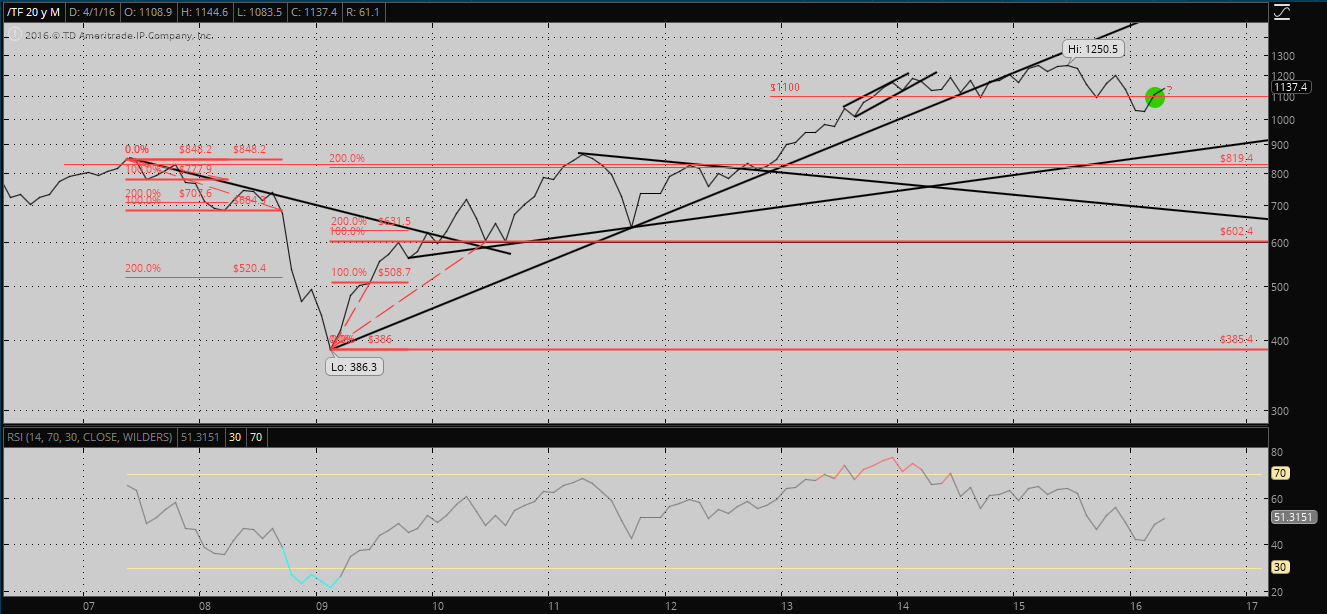

Long-Term IMO we have ‘successfully’ regained the support line. Nothing else has really changed here.

IMO we have ‘successfully’ regained the support line. Nothing else has really changed here.

Something a bit different. It’s a bit on the dreamy/spacey side of things but nice. Definitely a weird video as well…but hey at least it’s in English. I really should listen to songs in more than just Swedish but I keep discovering new songs in Swedish I like 😀 Anyways, here.

Comments

Pingback: Vindicated on oil. Still hate the volatility in it. EUR call wrong? | Eric's TA Alcove